Is My Money Safe? It's a Question on All of Our Minds. Here's What to Know

When banking regulators shut down Silicon Valley Bank (SVB) last week, it marked the second-largest bank failure in U.S. history. In just one day, customers tried to withdraw a staggering $42 billion—a classic “bank run” that unfolded in record speed largely due to panic that spread online like wildfire.

It wasn’t just those with money at SVB who panicked; runs on one bank sends ripples through the entire system, which can fuel widespread alarm and threaten cascading bank runs. Case in point: This week’s news that San Francisco-based First Republic Bank will receive $30 billion from other banks to meet increased customer withdrawals.

It’s understandable if all this banking news has prompted you to freak out and wonder if your money is safe.

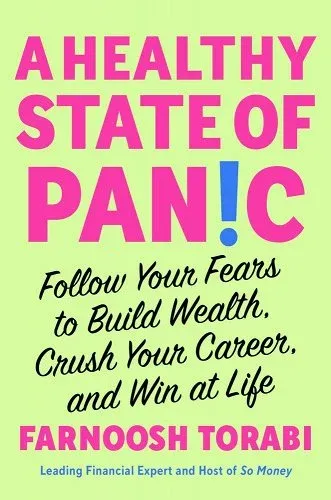

Farnoosh Torabi understands our collective fear. (In fact, her forthcoming book is called A Healthy State of Panic, and a big focus is on how financial fears can actually help us build wealth.) Yet rather than let worries about the recent banking news paralyze you, she wants it to catalyze you.

“This news isn’t a sign that where or how you’re banking is unsafe, and it’s not a reason to take your money out of the bank and keep it under your mattress,” says Torabi. “Rather, it’s an opportunity to turn your fear into something that can help you, and the best place to start is to check in with your finances.”

So, what should that financial check-up entail? What money moves did Torabi make in the wake of the SVB collapse? Read on for the answers to those questions and more.

A CONVERSATION WITH FARNOOSH TORABI

The SVB failure was the second largest in U.S. history—and has a lot of people wondering what it could mean for their personal finances. What would you say to those who are worried?

First, I would say that it’s completely normal and healthy to be concerned about your finances. Headlines like these are a reminder that we—as consumers, personal investors, earners, and savers—have a duty to be vigilant about our finances. Certainly, we can put our trust in institutions like banks and investment banks. Remember, it’s not in their best interest to fail us.

Second, SVB’s collapse proves that when a bank failure does happen, the government is prepared to step in and take the measures necessary to make the banks solvent again. We need to remember the good news that came out of this: The FDIC stepped in very quickly and contained the issue.

Finally, I think it’s important to honor your fear around this and ask: How can you turn that fear into something that can help you rather than let it paralyze you? The best place to start is to check in with your finances. Are you afraid because you’re banking somewhere that’s a bit off the beaten path? Maybe you haven’t checked if your money is FDIC insured? Let your fear take you to a place where you’re going to make a healthy move: Research your bank, and move your money if you must. (Click here to learn more about FDIC insurance.)

Try to be respectful of your fear; fear is there to protect us. But also, work with the facts of the situation. Another bank failure isn’t likely to happen again tomorrow or impact your finances. Historically, that’s not what happens.

Is there anything you’re doing differently with your money or financial plan considering the SVB collapse?

No. Honestly, I haven’t done anything differently. I hope that says something!

What I have done is read as much as I can about why this bank failure happened. I’m a journalist. I always want to know more. I can’t rest until I feel like I’m attaching some rationale or logic to things. For me, what’s key is learning more about how this happened and being sure to focus on the good news here: Entrepreneurs and startup founders with all of their money in SVB are now offering testimonials, saying “Look, we have our money now.” It’s easy to focus on the scary stuff, but the other side of this is a good reminder that the system works!

How do you avoid going to the dark place when you think about the SVB bank run—and potential for it to happen again, but this time to banks that many of us use for our personal finances?

The last time this happened was 11 years ago. Before that, the last bank run happened in the 1930s. I have an advantage because I cover this stuff every day for my job, which helps me come to this with less anxiety than the average person.

I’d also remind people who might be going to the dark place to focus on the very good news here: The FDIC proved again that they’re incredibly capable. They keep their word. Without the FDIC, the banking systems and our economy would fail. You’ve also got to remember that while nobody cares more about your money than you, it’s not in any government agency’s best interest to lose the confidence of the consumer. Everyone has something to lose, not just you. And that’s a good thing! When things like the SVB collapse happen, it’s all hands on deck when it comes to finding the solution.

What are some of the ways readers can protect themselves when it comes to their finances?

If you’re banking with a solid credit union, reputable bank, national or regional bank, I wouldn’t be worried. Just make sure your money is FDIC insured.

If you started banking somewhere brand new, digital only, and didn’t do any due diligence about things like whether or not the bank is FDIC insured or if there’s a large institution powering them, you may have a higher level of vulnerability. If that’s the case, look under the hood of your bank. Is there FDIC insurance? If you needed access to your money, how quickly could you get it? Could you walk into a bank and take your money out? These are some of the things we relinquish when we work with these digital banks that offer higher interest rates, and it’s important to be able to answer these questions.

What happens from here? Could another bank collapse happen again? What do you want everyone to know and remember during these interesting financial times?

Yes, it’ll happen again. But what I think we need to remember is that while there are some things we can’t control in life, we can control our personal finances. That’s our responsibility. Trying to predict or foreshadow what could happen in the economy, the market, or with the banking system? Nobody can predict that.

Trying to wrestle your brain around the what ifs isn’t a good use of your time. Instead, focus on what is true and controllable in your financial life. That’s it. You’ll benefit most from focusing on what’s actually within your realm of control.

Farnoosh Torabi is the host of the award-winning podcast So Money, and a sought-after speaker and author of multiple books. Her next is entitled A Healthy State of Panic, part-memoir, part-guidebook on how fear can be a superpower to achieve true wealth and career success. She is a graduate of the Pennsylvania State University with a degree in finance and international business and holds a master’s degree from the Columbia University Graduate School of Journalism. Farnoosh lives on the East Coast with her husband and two children. Learn more at FarnooshTorabi.com

Question from the Editor: Did the news of the SVB collapse prompt you to worry about your financial security? Have you taken any different financial steps in light of what happened?

Please note that we may receive affiliate commissions from the sales of linked products.